[ad_1]

In a world that offers very little in the way of interest, it does make sense that people will continue to favor some of the higher-flying currencies such as the South African Rand.

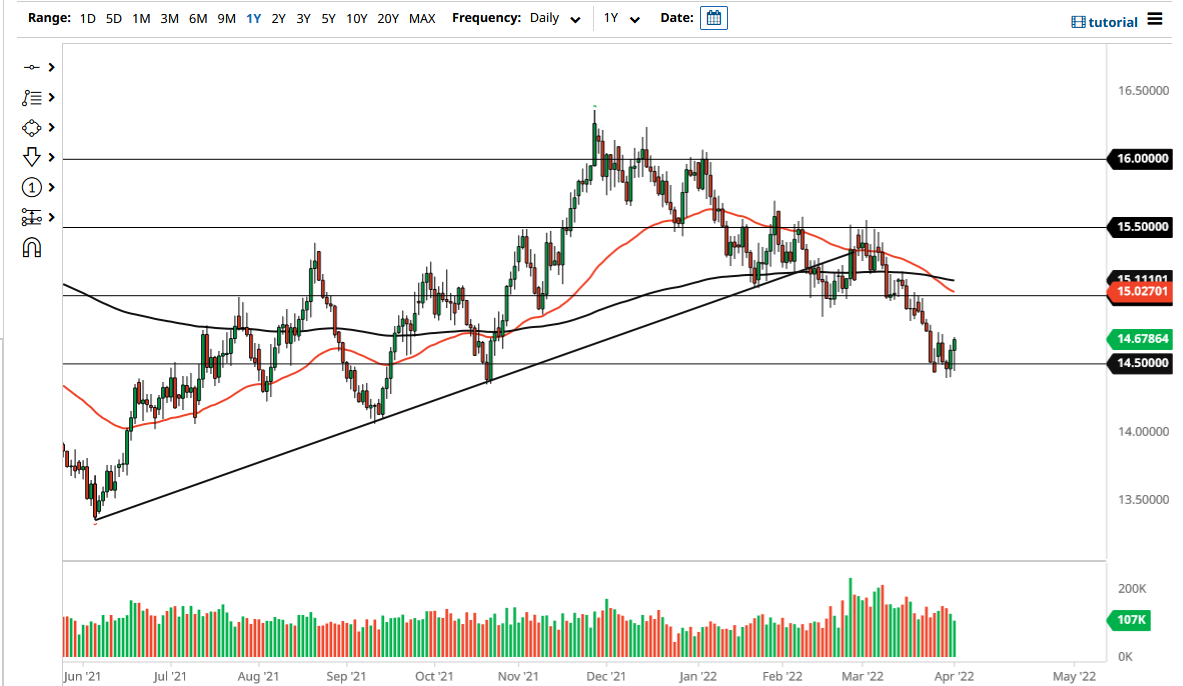

The US dollar has fallen to kick off the trading session on Friday, testing the 14.50 Rand level. This is an area that has been important multiple times, and therefore it is likely that the market will continue to see buyers in this general vicinity. That being said, the market looks as if we are trying to bounce from here, perhaps in a short-term recovery of the overall downtrend.

It should be noted that we just formed the so-called “death cross”, when the 50 Day EMA breaks down below the bottom of the 200 Day EMA. This is typically a very negative turn of events, and it does suggest that perhaps we could go lower at this point. If we do, then we need to break down below the 14.40 Rand level to clear the support region that we have been testing for a while.

The question now is more or less whether or not we can break down from here, not necessarily whether or not we are negative enough to do so. The market has been selling off for a while and you could look at this as a potential “working off the froth” of the overall downtrend. If that is the case, then we will break down and go much lower.

On the other side of the equation, we could rally and bounce to the 15 Rand level, which would be a significant recovery. However, I would anticipate that there would be a certain amount of sellers in that area that could put downward pressure on this market, and I think that would be about as far as this pair is likely to bounce during a move like that. After all, the trend has been down for a while and I think that continues to be the case going forward. In a world that offers very little in the way of interest, it does make sense that people will continue to favor some of the higher-flying currencies such as the South African Rand.

The market will continue to be very choppy and volatile, but at this point, it is very likely that we see a lot of external factors coming into the picture, not necessarily anything related to shaft Africa itself.

[ad_2]