[ad_1]

When a market gets parabolic the way this one did, it quite often is a sign of significant overextension.

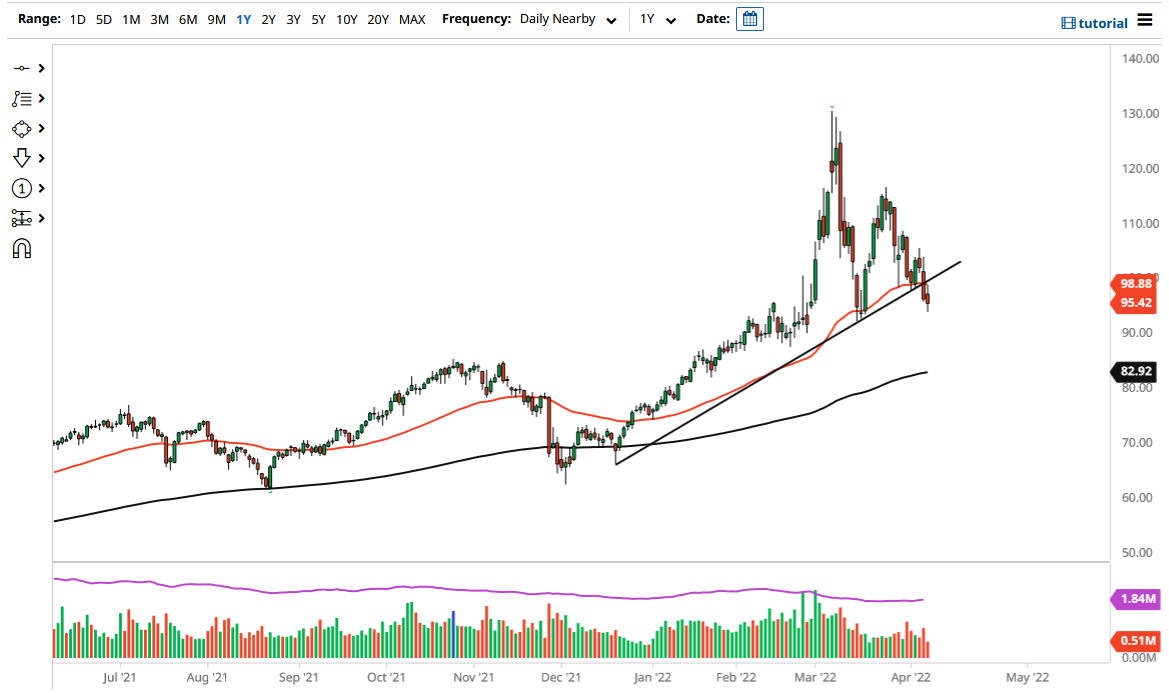

The West Texas Intermediate Crude Oil market initially rally during the trading session on Thursday to retest the 50 Day EMA and of course the previous uptrend line. Because of this, it looks as if the downtrend is intact, and I do think that it is probably only a matter of time before crude oil breaks rather significantly, perhaps reaching the $95 level early during the session on Friday, and maybe even breaking down below there.

If we do break down below that level, then I will be targeting the $90 level. The market is going to be concerned about the fact that gasoline demand is dropping, which of course is a situation where perhaps the market had gotten so far ahead of itself that it forgot that the “cure for higher prices is higher prices.”

As the world looks likely to head into recession, this is weighing upon the crude oil market because it will drive demand down. There is a structural problem with supply over the longer term, but perhaps a recession might give the oil industry a chance to catch up. As we had been locked down due to the pandemic, it is not a huge surprise that when the economy opened up around the world that the demand shock pulled prices much higher. Now that it looks like the tide is turning, we may see oil drop rather significantly.

On the upside, if we were to take out the top of the Wednesday candlestick, then it is possible that the WTI Crude Oil market could go higher, perhaps reaching the $110 level, maybe even the $115 level. All things have been equal, it looks as if oil is starting to lose its mojo, making lower highs along the way. As long as that is going to be the case, then I think that you continue to fade rallies, but you should keep in the back of your mind that oil markets have been extraordinarily volatile, especially with the Russian supply essentially being taken off of the open market. The US dollar has its influence as well, but this market has been rather strong for a while, and now it looks like it is finally running out of momentum. When a market gets parabolic the way this one did, it quite often is a sign of significant overextension.

[ad_2]