[ad_1]

I have no interest in trying to short this market until we break below the $100 level.

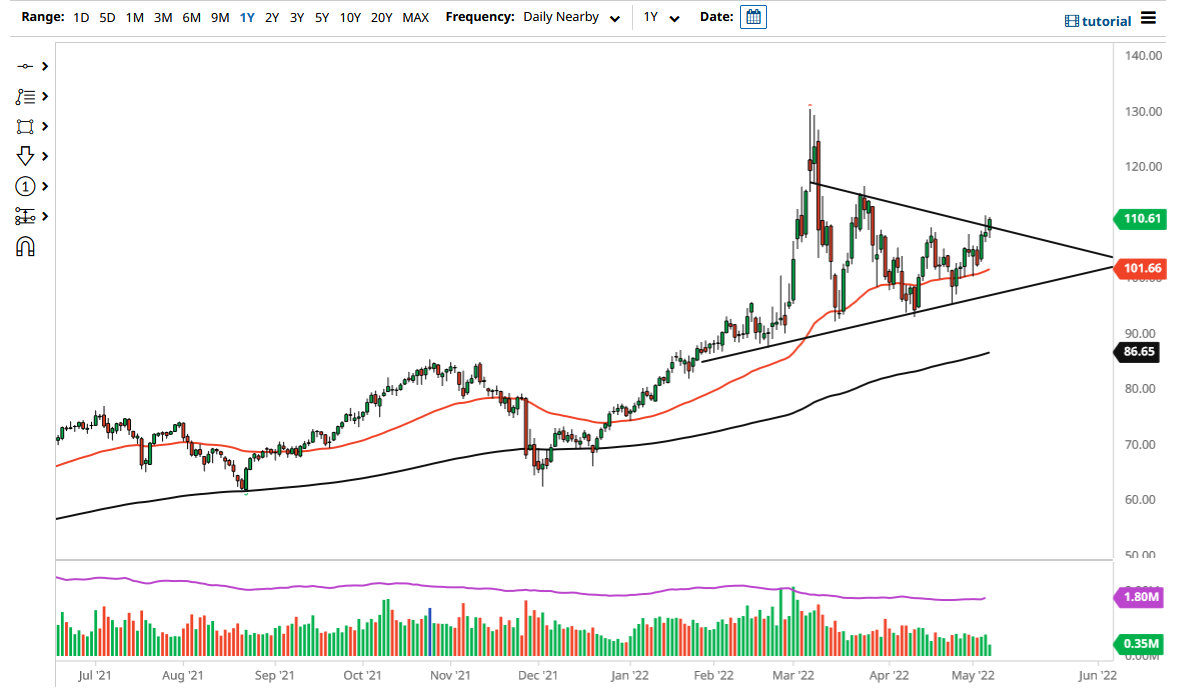

The West Texas Intermediate Crude Oil market initially pulled back on Friday but then turned around to show signs of strength yet again. We are now threatening the top of the shooting star from the previous session, and it looks like we are going to go higher. Ultimately, the $115 level would be a target, perhaps even the $120 level after that.

Short-term pullbacks will continue to attract a lot of attention, especially as the $105 level has offered both support and resistance previously, and then after that, we have the 50-day EMA which is at the $101.66 level and rising. It has offered quite a bit of dynamic support for a while, so it does make quite a bit of sense that we would see buyers on these dips, and because of this I think it will more than likely continue to attract a bit of momentum to the upside. Furthermore, we also have to keep in mind that the economy is reopening and oil will continue to be a high priority.

Keep in mind that the Russian oil supply being threatened has a negative effect on the markets as well, so given enough time it is likely that we will see an attempt to go much higher and based on the triangle that I have drawn on the chart, we could see a “measured move” to the highs that we had recently made. The initial surge higher was due to the Russian invasion of Ukraine, but now that we are grinding higher, it is a much more sustainable move. The market will continue to be well supported as the overall momentum has been so positive. I would anticipate more of the same, a simple sawtooth pattern to the upside.

However, if we break down below the 50-day EMA, the market is likely going to threaten the $100 level. If we break down below the $100 level, then $95 will be the next target. Ultimately, this is a market that I think will find plenty of interest going forward, despite the fact that the US dollar is so strong. Distillates continue to shrink as far as inventory is concerned, so petroleum prices will continue to rise as well. I have no interest in trying to short this market until we break below the $100 level.

[ad_2]