[ad_1]

At this point, you need to be very nimble and cautious about your position size more than anything else.

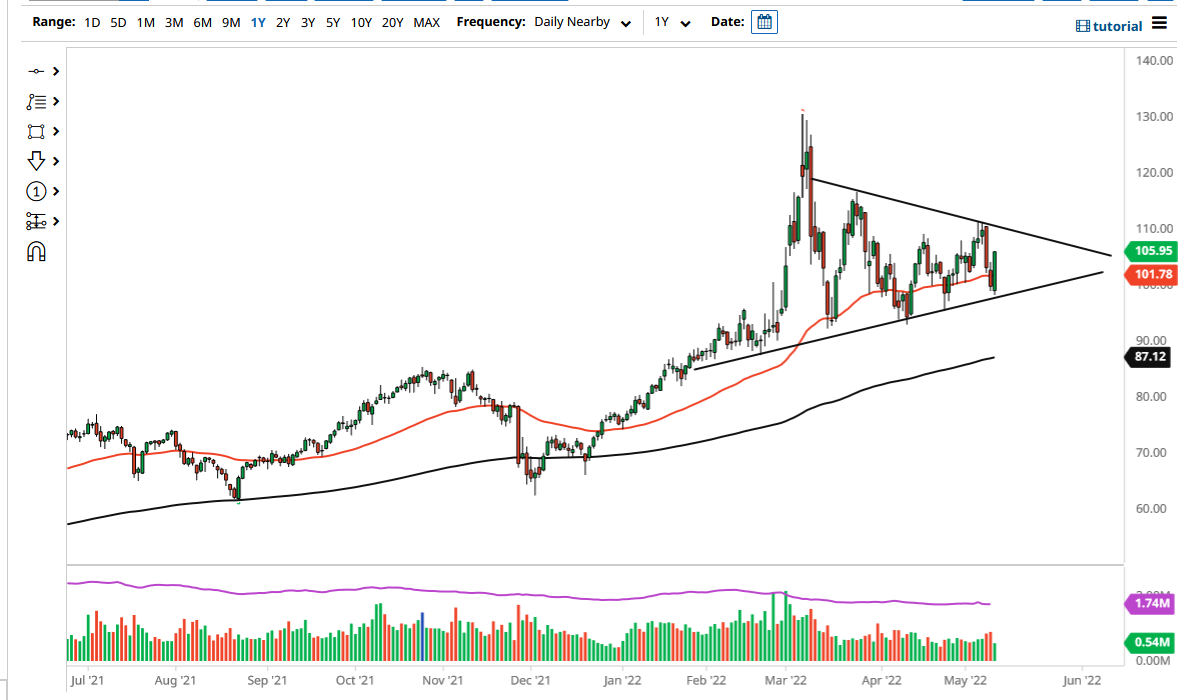

The West Texas Intermediate Crude Oil market broke much higher on Wednesday as we are clear of the 50-day EMA. Ultimately, this is a market that seems to be very noisy and unsure, as we have been grinding away in a symmetrical triangle for what seems like a lifetime. Keep in mind that there are a lot of external factors pointing in both directions, so it does make sense that we would continue to see this type of behavior.

The Russian supply has been taken offline, so a lot of the major powers will continue to suggest that we should go higher, just as the idea of the market getting slammed by demand due to the reopening of trade should. The market will continue to see a lot of volatility, and it is worth noting that we have a couple of trendlines that have been fairly reliable.

As for a negative turn of events, I think you need to keep an eye on the fact that there is a lot of concern out there that the global economy is going to slow down. If that is going to be the case, then it is likely that we would see a lack of demand for crude oil, so you can make an argument for both directions at this point. The easiest way to trade this market is to simply trade price and follow with the market does, not what it “should do.”

This has been a very strong move to the upside, but it has not necessarily broken out of an area that makes it anything that is tradable. If we were to break above the $110 level, then it would be an explosive move to the upside that was just waiting to be had. On the other hand, if we break down below the $100 level on a daily close, then it is very likely that this market would fall apart, perhaps looking to get down to the $90 level eventually, which is where the 200-day EMA is currently rushing to. At this point, you need to be very nimble and cautious about your position size more than anything else. It is very likely that we continue to see a lot of volatility on a day-to-day basis.

[ad_2]