[ad_1]

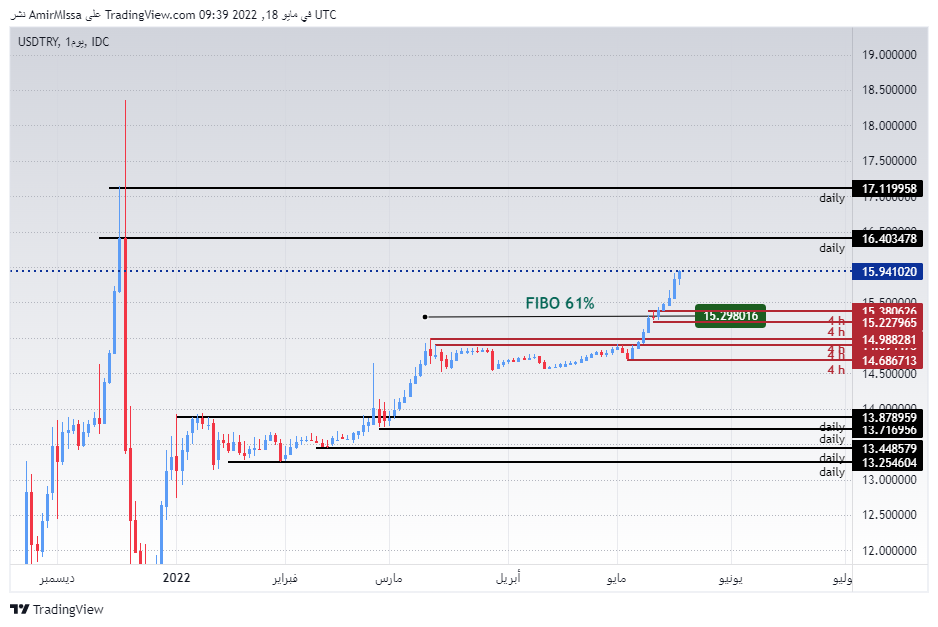

As the pair’s upward momentum continues, the way is open for the lira to reach 16.63 levels.

Today’s recommendation on the lira against the dollar

Risk 0.50%.

The buy trade of the target day recommendation was activated, and half of the contracts were closed at a profit with the price moving in the direction of the target and moving the stop loss point to enter.

Best entry points buy

- Entering a long position with a pending order from the current levels 15.85

- Set a stop loss point to close the lowest support levels 15.65.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 16.05.

Best selling entry points

- Entering a short position with a pending order from 16.00 levels

- The best points for setting the stop loss are closing the highest levels of 16.11.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 15.58

The Turkish lira continues to decline against the dollar, which was ranked as the third worst currency this year. The currency suffered from the failure of the monetary policy of the Turkish Central Bank, which is under the control of Turkish President Recep Tayyip Erdogan. The lack of independence of the Turkish Central Bank’s decisions reduced the effectiveness of the tools that it could resort to amid bad economic data. As the expansion of the current account deficit coincided with the rise in the trade deficit, inflation reached unprecedented rates for decades, as it approached the levels of 70 percent. At the same time, the Turkish Central Bank insists not to raise the interest rate, as it was satisfied with fixing it after a series of declines. This is contrary to the economic consensus that raising interest rates contributes to lowering inflation rates and helps currencies to rise.

On the technical front, the Turkish lira continues to decline strongly against the dollar, as the pair continues to rise above the moving averages 50, 100 and 200, respectively, on the four-hour time frame as well as on the 60-minute time frame. The pair is also trading the highest support levels, which are concentrated at 15.38 and 15.30 levels, respectively. On the other hand, the lira is trading below the resistance levels at 16.00 and 16.40. As the pair’s upward momentum continues, the way is open for the lira to reach 16.63 levels, which it recorded at the end of last year, as it is the first major resistance level. Please adhere to the numbers in the recommendation with the need to maintain capital management.

[ad_2]