[ad_1]

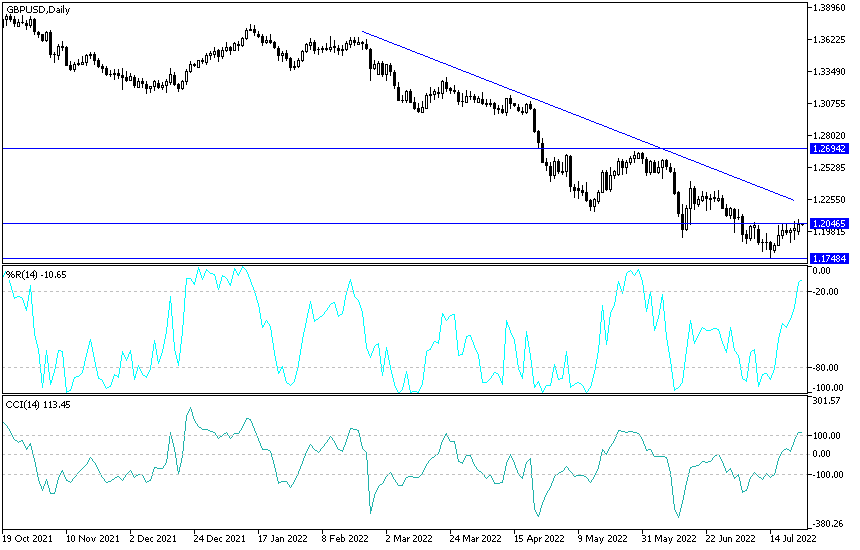

The GBP/USD exchange rate ended last week’s trading again above the 1.20 resistance level and may have a chance to recover more. This comes with the possibility of testing the 1.21 resistance, if the Federal Reserve commits tomorrow, Wednesday, to the June plan to direct US interest rates towards a “moderate restrictive level” by the end of the year. At the beginning of this important week’s trading, the sterling dollar pair jumped towards the 1.2086 resistance level, its highest in three weeks, and settled around the 1.2040 level at the beginning of today’s trading.

The US dollar was sold broadly in favor of the British pound and other major currencies last week after a single measure of long-term inflation expectations in the US fell in the previous period, and US monetary policy makers appeared to back away from the idea that a large US interest rate hike could Likely this week.

The resulting shift in market prices for the fed funds rate has provided relief to beleaguered risk assets and currencies while leading the Pound to the Dollar in multiple attempts to rise back above the 1.20 level, a level which the Pound eventually managed to hold above the weekend’s close. That was after the S&P Global PMI surveys shed light on the more important US service sector in a more turbulent light than the equally important European manufacturing late Friday afternoon, driving further declines for the dollar and smoothing the way for the Fed’s decision this week.

Expected US Interest

“I said the next meeting could revolve around a resolution between 50 and 75. That would put us, at the end of the July meeting, in that range — in that normal range,” Fed Governor Jerome Powell said closely at the June press conference. This is a desirable place.”

Wednesday’s decision is the most important event of the week for the GBP/USD rate, but Thursday’s US Q2 GDP data and Friday’s core PCE price index reading is also very important because of their potential implications for future Fed policy. The decision is widely expected to trigger a second increase of 0.75% in the US federal funds range which would raise the benchmark to between 2.25% and 2.5%, which also happens to be the middle of the estimated “neutral” range where costs do not stimulate borrowing does not hinder the economy.

This would leave sterling’s reaction dependent on any feedback on the pace the Fed intends to proceed with from September 21, the date of its next meeting, although that in itself will depend somewhat on US economic developments during these period. Commenting on this, Michael Cahill, a currency strategist at Goldman Sachs said, “While markets will once again focus on the rate hike at this meeting and guidance for September, the lesson from the June meeting is that it will be more important to focus on the Fed’s parameters to adjust its approach.” We will focus primarily on whether officials expand these criteria to focus more on slow activity data. Until this shift becomes more apparent, it will be difficult for the market to price a more accommodative Fed and a weaker dollar.”

GBP/USD Technical Outlook:

So far, the bulls’ domination of the GBP/USD pair is still weak, and according to the performance on the daily chart, there is a need to test the resistance levels 1.2210 and 1.2345 to breach the general bearish trend. On the other hand, the return of the stability of the sterling-dollar pair below the 1.2000 level will support the bears to launch further to the bottom and evaporate the recent rising hopes.

I still prefer selling sterling dollars from every bullish level. Today, the economic calendar is devoid of important British economic data, and the focus will be on the announcement of US consumer confidence and US new home sales.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

[ad_2]