[ad_1]

For two days in a row, attempts to rise in the price of gold stop at the resistance level of 1739 dollars an ounce, amid the weakness of the momentum of the reversal of the recent bearish view of the gold market. The price of gold XAU/USD is stable around the level of 1718 dollars an ounce at the time of writing the analysis. At the beginning of this week’s trading gold futures settled lower, retreating after two consecutive days of gains, as investors looked forward to the US Federal Reserve’s monetary policy announcement, scheduled for Wednesday.

The Federal Reserve is widely expected to raise US interest rates by another 75 basis points to 2.5%. CME Group’s FedWatch tool currently indicates a 77.5% chance of a 75 basis point rate hike and a 22.5% chance of a 100 basis point rate hike.

In general, the weakness of the dollar helped limit the decline in gold.

Where are stocks headed today?

Wall Street markets wrapped up a choppy day of trading with a mixed end to US stock indices on Monday, as investors brace for another sharp interest rate hike by the Federal Reserve this week as the central bank battles US inflation. According to the performance, the S&P 500 index rose 0.1% after fluctuating between gains and losses. The Dow Jones Industrial Average rose 0.3%, while the Nasdaq Composite was down 0.4%.

Smaller US stocks outperformed the general market, sending the Russell 2000 Index up 0.6%.

Major indices posted solid gains last week after a mix of mostly better-than-expected corporate earnings reports. Lower yields in the bond market also helped ease pressure on stocks after expectations of a US interest rate hike by the Federal Reserve drove yields up a lot this year. Tomorrow, most economists expect the Fed to announce a three-quarter percentage point increase in the US short-term interest rate, the second massive increase in a row it hasn’t done since 1994. 2.25% to 2.5%, the highest since 2018.

Wall Street markets will be closely watching Fed Chairman Jerome Powell’s press conference on Wednesday to learn about the next steps for policymakers.

US Treasury Secretary Janet Yellen said Sunday on NBC’s “Meet the Press” that the US economy is slowing, but healthy employment shows it has not yet entered a recession. I spoke ahead of a slew of economic reports due out this week that will shed light on the economy currently besieged by rampant inflation. Since the Federal Reserve’s last meeting in June, the government has reported that US inflation has accelerated to an annual rate of 9.1%, the highest rate since 1981.

Today’s XAU/USD Gold Price Forecast:

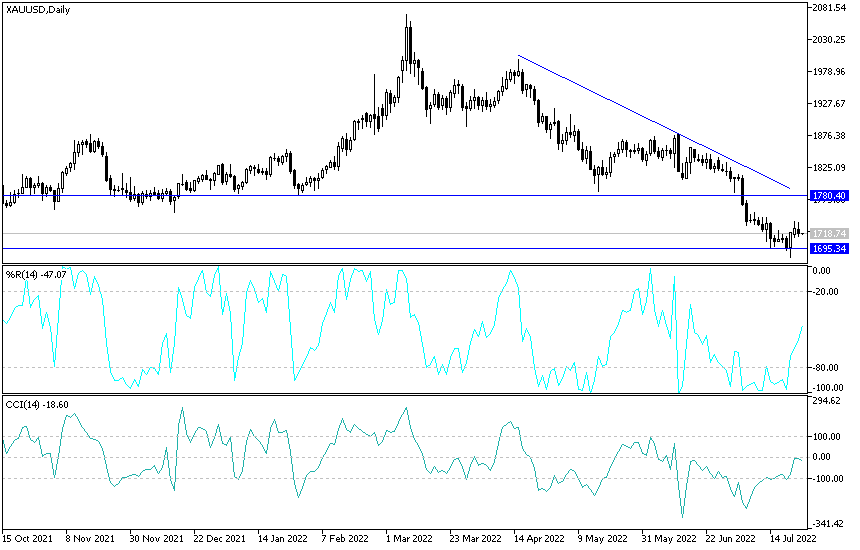

On the daily chart, XAU/USD gold price is still trying to break the bearish trend and so far it has not succeeded. As I mentioned before, the bulls will not have the opportunity to launch higher without testing the resistance levels 1755 and 1778 dollars, respectively. The last level is important to expect the psychological resistance of 1800 dollars an ounce again. On the other hand, and over the same time period, a move towards the support levels of 1710 and 1685 dollars will be an opportunity for the bears to gain more control over the direction of gold.

So far, I still prefer buying gold from every descending level. The price of gold may continue to move in narrow ranges until the markets and investors react to the US interest rate hike decisions and then announce a package of US economic data led by GDP growth, consumer spending price index and US consumer confidence.

Ready to trade today’s Gold prediction? Here’s a list of some of the best Gold brokers to check out.

[ad_2]