[ad_1]

Spot natural gas prices rose in the last trading at the intraday levels, to achieve new daily gains until the moment of writing this report, by 1.18%. It settled at the price of $8.010 per million British thermal units, after rising during yesterday’s trading by 2.39 %.

After a multi-day drop in natural gas production slumped on Tuesday leading to a quick recovery in natural gas futures, NYMEX gas futures for September settled up 24.4 cents a day at $7.833/MMBtu. October futures were up 24.7 cents at $7.825.

NGI’s Spot Gas National Avg spot prices also regained some of the previous days’ losses despite thunderstorms expected to cool temperatures across large swathes of the United States. It rose about 5.5 cents to reach $7,900.

The US Energy Information Administration (EIA) said in its latest monthly forecast that spot prices for natural gas at the Henry Hub are on track to average $7.54 per million British thermal units for the second half of 2022 before dropping to $5.10 in 2023 as production rises.

In its updated version of its short-term energy outlook published on Tuesday, the Energy Information Administration said prices on the national index averaged $7.28 in July. This is a sequential decline from average prices of $7.70 in June and $8.14 in May, due to the growing slack in the market after the extended outage at the Freeport LNG terminal, the researchers said.

Natural Gas Technical Outlook

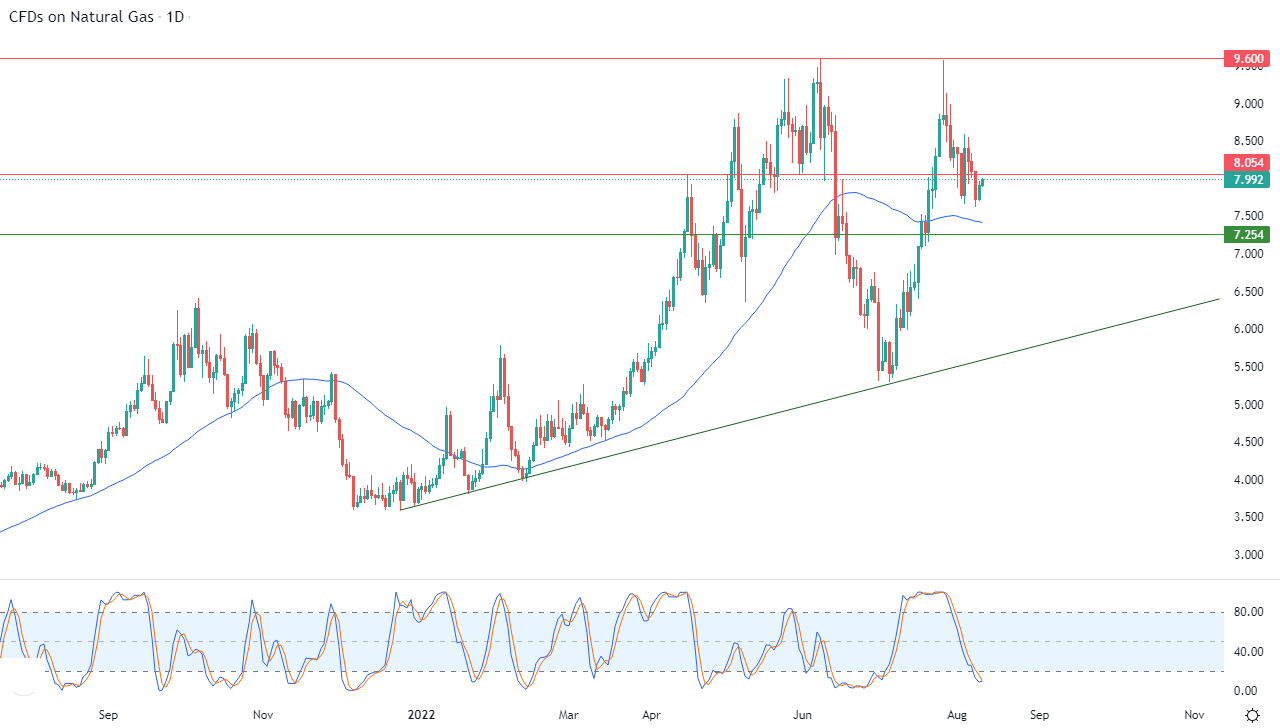

Natural gas finds some support due to the arrival of the relative strength indicators to very oversold areas, in an exaggerated manner compared to the price movement. This suggests the beginning of a positive divergence in it, in light of the continuation of positive support due to its trading above its simple moving average for the previous 50 days. The price is under the control of the main bullish trend over the medium and short term along with a minor slope line.

Therefore, our expectations indicate an increase in natural gas during its upcoming trading, especially in the event of its stability returning above the level of 8.054, to target the pivotal resistance level 9.600 after that.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodity trading brokers to check out.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodity trading brokers to check out.

[ad_2]