[ad_1]

The price of gold extended its longest stretch of its weekly losses this year as investors look to higher Treasury yields and a stronger US dollar ahead of a flurry of inflation numbers expected from major economies in the coming days. At the beginning of this week’s trading, the price of gold fell to the level of 1852 dollars an ounce, losing about 30 dollars from the price of an ounce. It settled around this level at the beginning of trading today, Tuesday, waiting for factors to rebound higher or continue to correct towards the psychological support of 1800 dollars an ounce.

The price of the yellow metal is retreating from a weekly gain of 0.3%, bringing its year-to-date gains to around 2%. As for the price of silver, the sister commodity to gold, it trimmed some of its losses. Silver futures for June fell to $22.12 an ounce. The price of the white metal fell by 2.47% last week, which increased its decline since the beginning of the year 2022 to date by more than 5%.

Bullion prices have fallen since mid-April as the US Federal Reserve and other global central banks tighten policy to fight rising consumer prices. Monetary pressure has pushed yields on US government bonds above 3% and fueled the dollar for five weeks of gains, making gold less attractive.

There could be more volatility in the bond market as a slew of inflation data feeds the discussion about price pressures and monetary policy. US consumer prices will be released on Wednesday, with China, India, Mexico, and Brazil all reporting during the same week.

Investors also digested trade data from China on Monday that showed the damage from the Covid-19 shutdown in the world’s second-largest economy. The country’s exports and imports struggled in April as a worsening virus outbreak slashed demand, undermined production, and disrupted logistics. Commenting on this, Ravindra Rao, Head of Commodity Research at Kotak Securities Ltd. The downside is limited by rising concerns regarding China, inflationary concerns, and tensions over Russia’s war on Ukraine.

Has inflation peaked? Goldman Sachs believes, as chief economist Jan Hatzius has written, that multiple signs point to a deceleration in key inflation measures. “For the first time since price hikes began in early 2021, we revised our baseline forecast for the end of 2022 to reduce personal consumption expenditures,” Goldman Sachs analysts wrote to clients. We are now more confident that both core and core inflation have peaked on an annual basis.”

This can create an intriguing atmosphere for gold. On the other hand, slowing inflation will not look attractive to safe haven assets like gold. Slowing inflation may force the Fed to be less aggressive, allowing the central bank to remain accommodative compared to other periods historically.

In other metals markets, copper futures fell to $4.172 a pound. Platinum futures fell to $933.80 an ounce. Futures contracts for palladium fell to 2021.50 dollars an ounce.

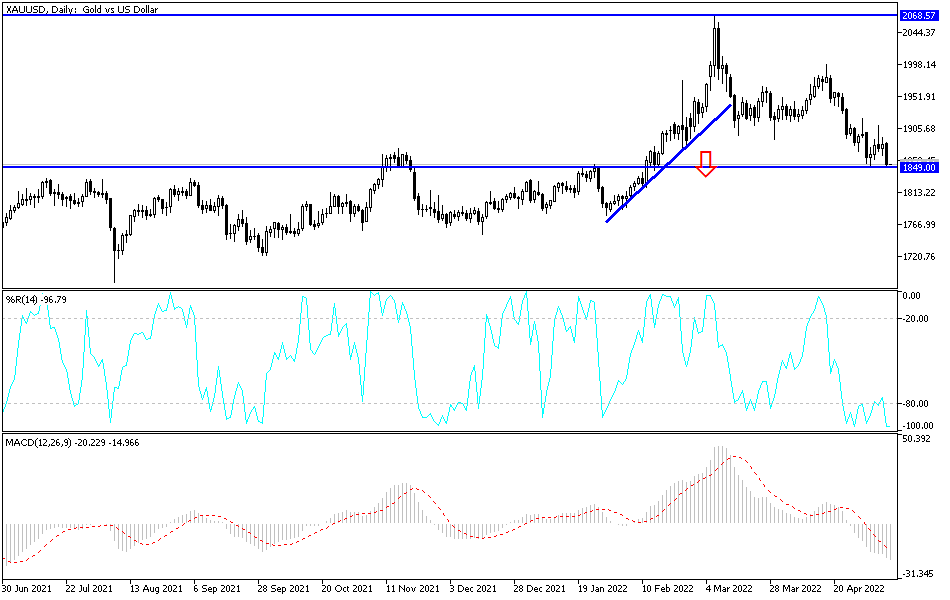

According to the technical analysis of gold: On the daily chart below, it seems clear that the price of gold is moving freely within a bearish channel. Breaking the support of $1835 an ounce is important for a stronger control of the bears, because with it the opportunity to move will increase to break the psychological support of $1800 an ounce. Despite that, I still prefer buying gold from every descending level. Global geopolitical tensions, the impact of a new outbreak of the epidemic, and the continuation of the Russian-Ukrainian war are factors that support the gold market, which is facing a wave of interest rate hikes by global central banks led by the United States.

On the upside, the resistance levels are 1878 and 1900 dollars for the return of the bulls’ stronger control over the gold market.

[ad_2]