[ad_1]

You cannot argue with the overall uptrend and therefore I would need to see a pretty significant shift in attitude to start selling.

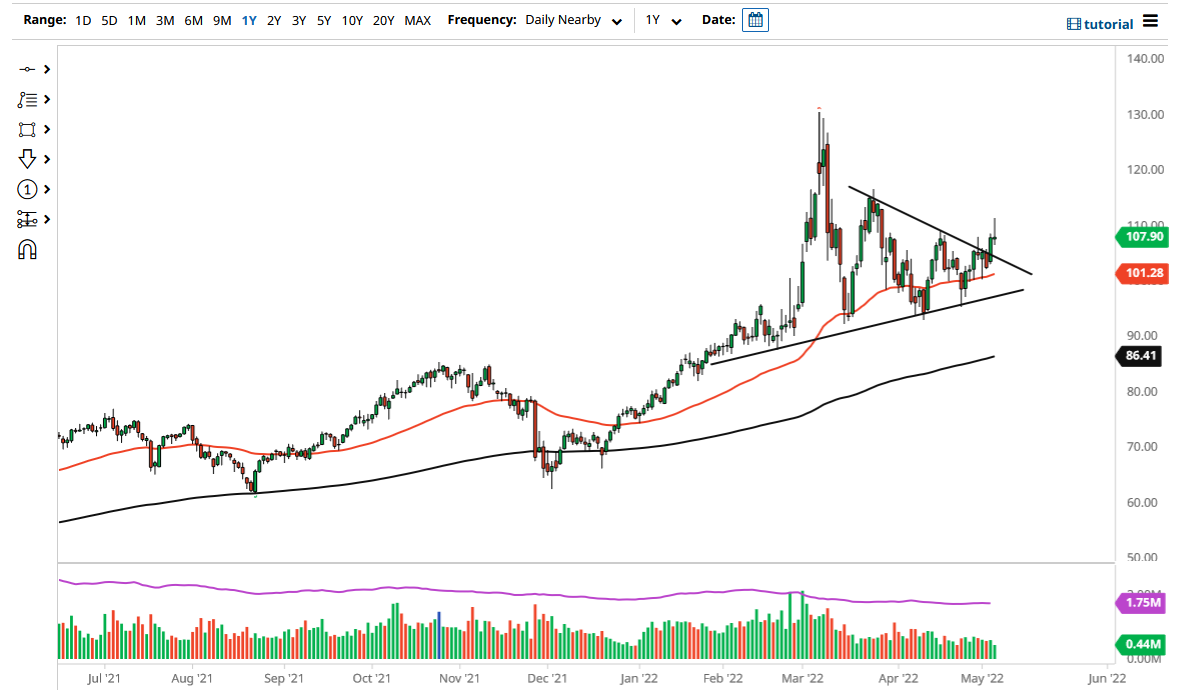

The West Texas Intermediate Crude Oil market rallied significantly during the trading session on Thursday to break above the $110 level. However, we have seen the market turn around and show signs of weakness, and therefore it looks like we are going to close the day with the shooting star. The shooting star of course is a very negative candlestick, and it makes a lot of sense that we would see a bit of a potential pullback to find support underneath. The 50 Day EMA is sitting just above the $101 level and rising.

Any pullback at this point will be thought of like value, as crude oil continues to find plenty of buyers. Ultimately, this is a market that I think is not worth shorting, at least not until we break down below the 50 Day EMA, and perhaps even the uptrend line underneath there. The market breaking down below that uptrend line could send crude oil down to the $90 level, which would start to meet up with the 200 Day EMA. The main reason why think we could do this is that the global growth situation does not look very good, and therefore demand for crude oil could fall. However, the market has been bullish for some time, and of course, I think that momentum continues to be a major player in the market. The Russian supply of crude oil is somewhat taken out of the market has had a major effect, but only time will tell how that plays out.

If we turn around a break above the top of the shooting star for the trading session on Thursday, that would be a very strong sign as we would not only break through the short-term support, but we will also have broken through the $110 level. I would need to see a daily close above there to get confident to hold onto this contract, but in the meantime, we may have a short-term pullback that we can look to for value. Over the last week or so, the 50 Day EMA has been rather reliable, so one would assume that would be the case over the longer term. Expect a lot of choppy behavior, but at this point, you cannot argue with the overall uptrend and therefore I would need to see a pretty significant shift in attitude to start selling.

[ad_2]