[ad_1]

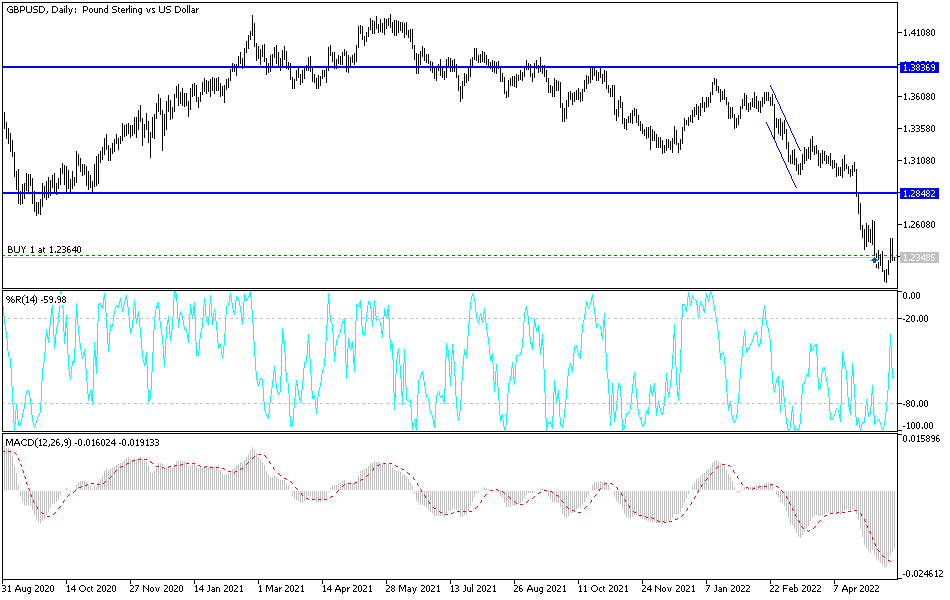

Sterling fell strongly after the UK’s headline CPI inflation recorded 9.0% yeary-on-year, lower than the 9.1% market had been expecting, but remarkably up from 7.0% recorded in March. The bulk of the gains in inflation were linked to higher energy costs due to Ofgem’s price cap hike in April, and thus economists were largely expected. Accordingly, the price of the GBP/USD currency pair quickly gave up the rebound gains, which reached the 1.2500 resistance level, quickly dropping to the 1.2326 level in the beginning of trading today, Friday.

The next rise in energy prices comes in October when UK inflation is expected to peak near 10%, according to the Bank of England’s forecast. Inflation remains undoubtedly hot, but today’s disappointing numbers against expectations may offer hopeful crumbs to put pressure on households.

CPI inflation rose 2.5% month over month in April, the Office for National Statistics said, up from 1.1% previously, but disappointing versus the 2.6% market expectation. Core CPI, which strips out energy effects and gives a more “organic” feel to domestic inflation, rose 6.2%, but this was in line with market expectations.

On a monthly basis, core rose 0.7% which is already below expectations of 0.8%. Thus, the data does not come as a huge surprise and will not change market expectations regarding a future rate hike from the BoE, and therefore is not likely to have a significant impact on the GBP. However, there was an indirect move down in GBP after the release, which is understandable given that many trading algorithms would be ready for such a move.

For his part, says Callum Pickering, chief economist at Berenberg Bank. From a currency perspective, the question is whether yesterday’s inflation, wages and employment data changes the dial on the number of interest rate hikes the BoE will deliver over the coming months. It appears that the stronger-than-expected wages data encouraged the markets to take further gains, which was reflected in a sharp move higher in the British Pound.

Subsequent inflation data does not have quite the same effect.

Indeed, given both sets of data, Pickering is not convinced that the bank will be inclined to precipitate offering higher interest rates. The bank said: “The big rise in wages in March was due to huge bonuses rather than the sharp acceleration in core wage growth, the big rise in CPI driven by the overseas-driven rise in energy prices, and BoE policymakers are likely to be less concerned with the latest data. than some of the headlines might suggest.

This could deprive the pound of a basic idea of the rise.

“Nothing gets worse forever,” says Morgan Stanley. Morgan Stanley says the dollar should head down decisively by the fall, which will allow the British pound and other major currencies to recover. And in a mid-year strategy update, Morgan Stanley analysts expect more strength in the Northern Hemisphere summer, although this strength is expected to be modest and will ask questions about the bearish outlook in the analyst community for levels below 1.20.

The pessimism of the Bank of England, along with the contrasting results of the recent British economic data and the return of Brexit skirmishes, will remain factors of weakness for the performance of the GBP/USD currency pair in the coming days. Attempts to rebound may be opportunities to consider selling the GBP/USD. A breakdown below the support 1.2220 is important to look towards the next psychological support 1.2000. On the other hand, and as I mentioned before, a strong reversal of the current trend will not occur without the pair breaching the resistance levels of 1.2850 and 1.3000; otherwise the general trend will remain bearish.

[ad_2]