[ad_1]

The size of the selloff is quite drastic, and it does suggest that we are starting to see even more panic enter the market.

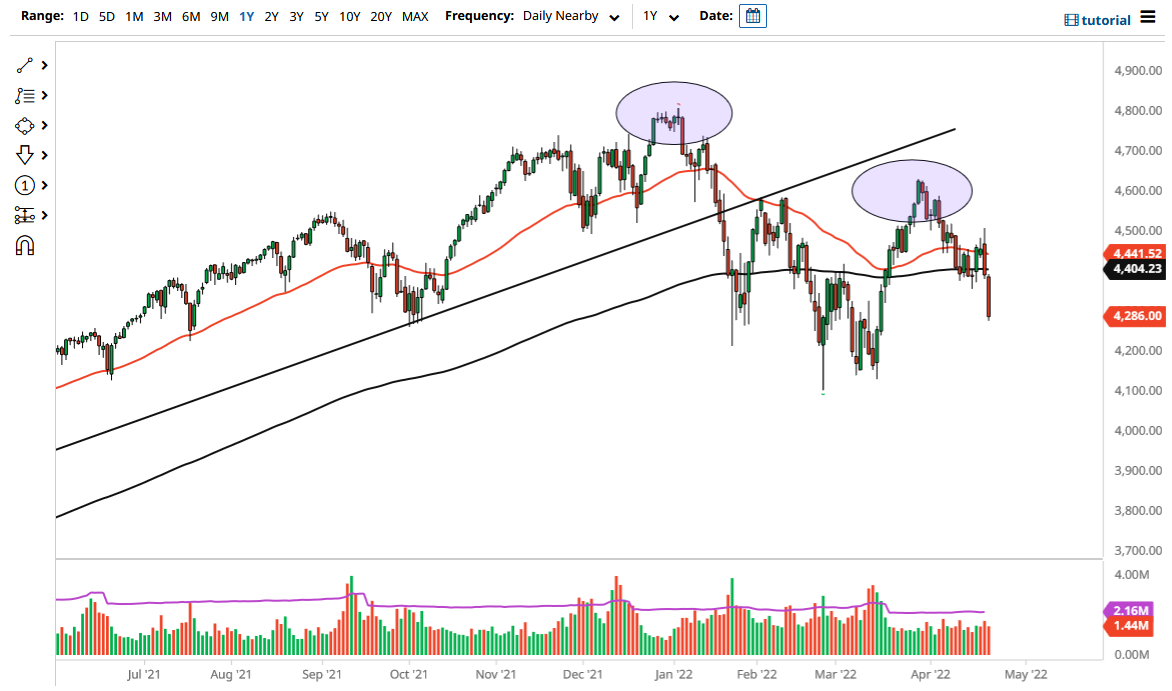

The S&P 500 got hammered on Friday to break down below the $4400 level and even broke down below the 4300 level. At this point, the market looks as if it is going to continue to go much lower, so you need to be very cautious about the overall attitude of the market, as it looks like it is threatening a serious breakdown. Short-term rallies at this point will more likely than not continue to see plenty of selling, and I think at this point it is likely that we would see multiple opportunities going forward.

Above current trading, we have the 200-day EMA sitting near the 4400 level, so I think that does have a major influence on any type of rally. Beyond that, we also have the 50-day EMA above there, and I think there is a huge “resistance zone” waiting just above for any type of rally. It is also worth noting that the Federal Reserve continues to reiterate the idea that they are in fact going to remain very aggressive and hawkish, and that works against the value of the stock market as interest rates continue to climb. As long as the 10-year note continues to sell off, it is likely that we will continue to see pressure on the stock markets.

We look like a market that has further downward pressure just waiting to happen, so it is likely that we will continue to see that the 4500 level above will offer a massive resistance barrier. A move above the 4500 level would be extraordinarily bullish, opening up the possibility of a move to the 4600 level, and perhaps even building a bit of an inverted head and shoulders. However, the likelihood of that has dropped quite significantly over the last 48 hours. The size of the selloff is quite drastic, and it does suggest that we are starting to see even more panic enter the market. Because of this, and the fact that the US dollar has been like a wrecking ball for risk assets, it makes sense that we continue to see pressure. From a fundamental driver situation, I do not know anything other than the Federal Reserve changing its attitude could push this market back around to the upside.

[ad_2]